A STRATEGIC APPROACH TO ANALYZING REAL ESTATE DEALS IN UNCERTAIN TIMES

In today's unpredictable economic landscape, the real estate market in vizag has become a focal point for both seasoned investors and those new to the investment scene. The ongoing global challenges like property prices, upgrading market trends, and low inventory levels have brought about a need for a strategic approach to analyzing real estate deals, enabling investors to make informed decisions that withstand the test of troubled times, to overcome these hurdles, and to convert these unpredicted risks into successful investments. This article delves into a comprehensive framework for evaluating real estate opportunities, considering factors that have gained prominence in these uncertain times.

Market research and trends

Before delving into any real estate deal in Vizag, it's imperative to conduct thorough market research. In the current confused environment, understanding market trends becomes even more critical. Start by examining recent sales data, rental trends, and inventory levels. Identify any shifts in demand for particular property types or due to changing work-from-home dynamics, urban flight, or other socioeconomic factors. Scrutinizing these trends provides a solid foundation for making educated investment decisions.

Location analysis

Location has always been a crucial factor in real estate deals in Vizag, but its significance has magnified in troubled times. Consider properties that are located in areas with resilient economies, diverse job markets, and access to essential amenities. Urban centres that cater to remote work preferences and offer a mix of residential, commercial, and green spaces are gaining grip. Analyze the neighbourhood's growth potential and stability, as these factors can significantly impact the property's long-term value.

Cash flow evaluation

Cash flow analysis is a fundamental aspect of real estate investing in vizag, especially in uncertain times. Rental income stability is most important, as financial concerns can impact tenants' ability to pay rent. Factor in potential vacancy rates and changes in market rents when projecting cash flows. Additionally, assess the property's operating expenses, including property management, maintenance, and taxes. A property with positive cash flow provides a buffer against economic fluctuations.

Considering financial sources

Financing terms can greatly influence the viability of real estate deals in Vizag. In today's financial landscape, interest rates remain historically low, but getting the required amount at a time of uncertainty is very difficult. Consider the source of financing by taking a loan from the seller, making a deal with the tenant to purchase a house, or taking money from lenders. Evaluate different mortgage options and their long-term implications. Keep in mind that a fixed-rate mortgage can provide stability in uncertain times, shielding investors from potential interest rate hikes. At the same time, high interest rates can be considered if the property you are purchasing is worthy of investment immediately and if you are able to afford to pay.

Risk Mitigation

The most crucial thing is risk mitigation in real estate deals in Vizag, especially when the future is uncertain. The key to investing is diversification. Think about distributing your funds among commercial, residential, and land. Check the property carefully for any maintenance issues that can arise and become more serious during difficult financial circumstances. Additionally, look into insurance solutions that offer protection from unforeseeable circumstances to protect your investment against unforeseen losses.

Long-Term Investment Perspective

A protection against short-term market volatility can be obtained by investing long-term in real estate deals in Vizag. Even though it can be difficult to gauge the market, attempt to invest in long-term investments that will have a steady cash flow over the course of your lifetime, even though short-term investments typically provide higher returns. Similar to how having a rental property is the ideal long-term investment because you can still receive money during tough financial times,

Exit strategy planning

Crafting a well-defined exit strategy is essential, even more so in uncertain times. Consider various scenarios, holding onto the property for rental income, selling when the market rebounds, or converting the property for a different use. Having a flexible exit plan allows you to adapt to changing market conditions and make the most prudent decision for your investment.

Network and Expert Consultation

Using a network of real estate transactions in Vizag, experts can provide insightful information during unpredictable times. Based on their experience and market knowledge, real estate agents, property managers, and financial consultants can offer knowledgeable advice. You may make wise judgements by working with experts who are familiar with the current real estate market.

Conclusion

Real estate investment requires a methodical and cautious strategy to get through difficult times. Investors can position themselves to flourish in the face of uncertainty by rigorously analyzing market patterns, carefully evaluating properties, and thinking long-term. Even though difficulties are unavoidable, a carefully considered real estate deal that takes these turbulent times into account can offer a reliable and profitable investment opportunity. Remember that making wise decisions, being flexible, and having a dedication to the long-term success of your real estate endeavours are the keys.

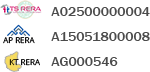

Consult strategic Analyzing partner Honeyy Group, a top real estate company in Visakhapatnam. Who can analyze the market and guide you in evaluating the correct property in uncertainty. We have built a number of projects during the market downturn. Today, we are at the top at quality standards all over India. We have 5000+ satisfied customers all over 3 states (Andhra Pradesh, Telangana, and Karnataka). To know more about us, visit our website at www.honeyygroup.com, and our contact number is 7610666999.