GOVERNMENT POLICIES ON REAL ESTATE

Impact of Government Policies on Real Estate Sector

The real estate sector plays a vital role in the economic development of any country, and India is no exception. As of 2024, the real estate industry continues to evolve under the influence of various government policies, regulations, and reforms.

These policies aim to bring transparency, accountability, and growth to the sector while ensuring that buyers and developers operate within a fair and well-regulated environment. This blog explores the current government policies, their impact on the real estate market, and how they shape the sector in 2024.

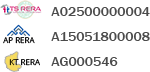

1. Real Estate Regulatory Authority (RERA) Act

The Real Estate (Regulation and Development) Act, commonly known as RERA, is one of the most significant reforms in the Indian real estate sector. Introduced in 2016 and implemented across various states, RERA has transformed the way real estate operates in India.

Key Features of RERA:

- Transparency and Accountability: RERA mandates that developers register their projects with the regulatory authority and disclose key project details, including timelines, cost structures, and layout plans. This has helped reduce the prevalent issue of project delays and buyer dissatisfaction.

- Buyer Protection: Buyers now have access to all necessary information about the project, ensuring that they make informed decisions. Additionally, RERA allows buyers to file complaints against developers for any violation of the rules.

- Timely Completion of Projects: Developers are now bound to complete projects within the stipulated time frame, failing which they are subject to penalties.

2. Goods and Services Tax (GST)

GST is another policy that has had a profound impact on the real estate market. Real estate is taxed under GST, and buyers must pay GST on under-construction properties. However, the rates vary based on the type of property.

Key Features of GST in Real Estate:

- Affordable Housing: Under GST, affordable housing projects are taxed at 1%, which has boosted the development of affordable housing.

- Standard Rate for Non-Affordable Housing: For other residential properties, the GST rate is 5%, ensuring a standardized approach across the sector.

3. Affordable Housing Policy

The Government of India has been focusing on providing affordable housing for all through schemes such as Pradhan Mantri Awas Yojana (PMAY). This scheme aims to provide affordable housing to the economically weaker sections (EWS), low-income groups (LIG), and middle-income groups (MIG) of society.

Key Features of PMAY:

Subsidy on Home Loans: PMAY offers subsidies on home loans, making housing more affordable for the masses. The Credit Linked Subsidy Scheme (CLSS) under PMAY helps eligible individuals avail subsidies on interest rates for home loans.

Housing for All by 2024: The government has set an ambitious goal of providing housing for all by 2024, and under this scheme, many housing projects are being developed across India.

4. Benami Transactions (Prohibition) Amendment Act

The Benami Transactions (Prohibition) Amendment Act, introduced in 2016, was designed to curb the issue of black money in the real estate sector. Under this act, properties that are purchased under a fictitious name or do not disclose the real owner are considered "benami" and are subject to confiscation.

Key Features:

· Stricter Penalties: The act imposes stringent penalties on those involved in benami transactions, including imprisonment and hefty fines.

· Increased Transparency: This law has brought transparency to the real estate sector by discouraging the use of black money and encouraging legitimate transactions.

5. Foreign Direct Investment (FDI) Policy

India has been actively promoting FDI in the real estate sector to boost development and attract foreign investments. The FDI policy allows 100% foreign investment in real estate projects, subject to certain conditions.

Key Features:

· 100% FDI in Real Estate: Foreign investors can invest directly in construction development projects, including townships, housing, commercial premises, and infrastructure.

· Relaxation of Norms: The government has relaxed various conditions to make it easier for foreign investors to enter the Indian real estate market, such as reducing the minimum area requirement for projects.

6. Tax Reforms and Incentives

The Indian government provides various tax incentives to promote homeownership and real estate investments. These tax benefits help individuals and developers alike, contributing to the growth of the sector.

Key Tax Benefits:

· Tax Deduction on Home Loan Interest: Under Section 24 of the Income Tax Act, homebuyers can claim a deduction of up to ₹2 lakh on the interest paid on home loans.

· Deduction for Principal Repayment: Under Section 80C, homebuyers can also claim a deduction of up to ₹1.5 lakh for the repayment of the principal amount of a home loan.

Conclusion

Government policies in 2024 have significantly impacted the Indian real estate sector, bringing about a more transparent, accountable, and growth-driven industry. The implementation of RERA has restored trust in the market, GST has simplified taxation, and affordable housing schemes like PMAY have made homeownership a reality for many.

As the Indian real estate sector continues to evolve under the influence of government policies, it is expected to become even more robust and inclusive, contributing to the country's overall economic growth.

Know more about such blogs in our page by visiting our website: www.honeyygroup.com, and to contact us call at 7610666999 for more details.